These are my personal notes from reading a book provided free of charge, for download, by Nathan Lewis of NewWorldEconomics.com

He suggests that creating a wealthy nation, enriching the people and bringing a whole host of benefits beyond just wealth lies in two essential criteria.

A low tax rate and a stable currency.

What follows are a series of summaries of either his thoughts or my thoughts about his thoughts. I do not always differentiate between the two. Please comment below to share your thoughts on this topic.

Low Tax Rate

It’s thought that a low tax rate could be about 10% based on historical evidence. This is neither too high nor too low and with such a low rate, it is likely to encourage payment of the tax rather than avoidance of the tax. So it is good for business growth, good for foreign investments and good for the government as tax revenues are healthy and growing.

It does not go into details about the tax but states that the overall tax burden should be low, the tax system should be efficient, with a broad base, and light taxes on corporations, capital and investments.

This means that the tax collection system should function quickly and easily to incentivise people to use it and to avoid administrative costs. It should cover the majority of the population. And the author is not in favour of double taxation which occurs by taxing capital gains and dividends. Where the tax system is efficient then it may be possible to have a tax rate closer to 20% although 15% would be preferable for a flat tax and up to 25% as a level for the top 5% of earners if a non-flat tax system is used.

The most efficient tax collection systems seem to be through payroll taxes and value-added taxes. I previously discussed value-added taxes and considered them to be a fair way to apply taxes because they allow a person to live free from taxation if they choose to do so. They also enable tax rates to be determined based on factors related to the product being sold which could include its impact on the wider economy and its environmental impact.

Regarding payroll taxes, I see that they are efficient but I question the need for them. If people pay taxes when they buy then why should they also pay taxes when they earn? If corporations pay taxes on their profits, why should they also pay taxes for the people who help create those profits which then simply reduces the profits and in turn reduces the revenue from the tax on those profits? Maybe you could argue the opposite, a corporation is only a collection of individuals, and each individual profits personally by working there so why tax the legal structure which only exists to profit the individual owners and employees? This also makes sense and so the devil is in the detail, I guess, on this point. How exactly are the individuals profiting and what can the business do to hide its profits? For example, can the employees receive better income by being paid in dividends from shares in the company than by being paid a direct salary? This is a tax minimization scheme and only goes to reduce the efficiency of the overall system. It needs to be looked at as a whole to consider how it can be made efficient and effective.

Government Spending

He suggests that governments should base their spending plans on tax receipts and not plan the spending and then consider how to tax in order to afford the spending. Essentially tax policy should precede spending policy. Or the spending policy can be made a percentage. So old-age care could be 5% of tax receipts, rather than a fixed value. When the economy is struggling, then the government should not increase its burden on the population and government investment should also restrain itself. This goes contrary to the belief that the government should spend itself out of a recession.

There was something I read a number of years ago and I forget where now, possibly something by James Rickards, that said you cannot solve a structural problem with finance. The structure of the economy, the tax rates and mechanisms, the balance of government to private industry etc. cannot be fixed with investment programmes and minor changes to tax rates.

The Norwegian Example

It makes me think of the recent video I watched about Norway. They have a very healthy economy because of large oil reserves, good oil and gas export infrastructure and local energy production based on renewables. They therefore have a large budget surplus and so they invest the surplus in a Norwegian wealth fund. This wealth fund itself creates income for the Norwegian economy but when necessary the government can draw down some of the funds to pay for investments in excess of the tax revenues. The government has a strict legal framework in place ensuring that no more than 3% can be withdrawn in a single year and must be spent on projects benefitting the Norwegian populace. Where a growing economy can replicate this system then this would be the ideal. Not following the Chinese example of building empty cities only to find that no one wants to live in them!

A Stable Currency

The author writes about the complexity of the modern marketplace. However, advertising agencies, distributors, chemists, fertilizer manufacturers, farmers, storage manufacturers, grain mills etc. etc. all work in tandem to produce and sell wheat and each works independently at being profitable. Each responds to price changes in oil and labour and other expenses and the changes ripple throughout the marketplace with no central planning.

Now on a global scale, this is made more complicated by the often erratic movements in the currency markets that have nothing to do with the local conditions of each business. I can give a personal example of this, my employer is a manufacturer in Japan, and in Europe we basically import and distribute the products. However, the demand for the products should be driven by the marketplace, but often it is driven by currency fluctuations as local distributors choose to stock up on the products when the exchange rate is favourable and deplete their stock when the exchange rate is less favourable. This can be multiplied globally and the result is a very unpredictable demand and a difficult time in managing production capacity.

Gold and Silver are very good for the purposes of pricing because they have a universal appeal, having been used throughout Europe and Asia since before Christ with evidence dating back to 3000 B.C. They also have a very stable supply because as mining becomes more efficient, the discovery of new sources becomes more difficult. Furthermore gold and silver have been available on every continent meaning that no country has had a monopoly on its supply or pricing.

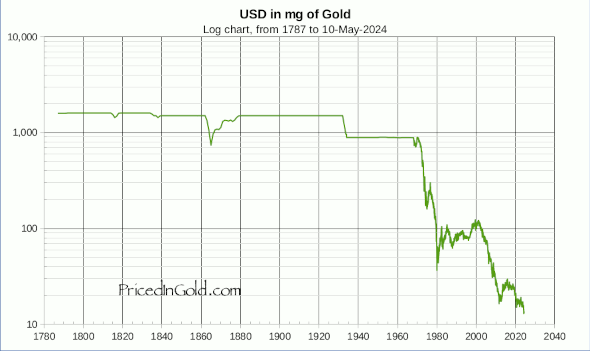

Gold itself has a more stable value than silver because aside from jewellery, it really has little purpose outside of investments. Silver, on the other hand, has many industrial uses making its pricing more reliant on the demand from the factories. Secondly gold does not rot, rust, or degrade over time so the value is maintained however long you keep it. Gold has had a stable value whatever timeframe has been considered and this is important for calculating profits, debt, rents, wages and pensions. As long as countries have tried to create coinage, they have tried to debase their currencies and ultimately the currencies have failed. In recent years, the statistics show that economies prosper the most when their currencies are the most stable. A stable currency makes the pricing of goods easy and efficient and the trading of goods easier and more efficient. As shown by my anecdote above, it can also smooth out demand curves and ease manufacturing forecasts.

Currencies today are often fixed not against anything stable like Gold, but against something perceived as stable, like the Euro or US Dollar. If the exchange rate is fixed then this can make trade with that, or those countries easier, but Governments do tend to make changes to their currencies. Exporters favour a lower-valued currency because their goods can then be sold more cheaply, but to lower the value of a currency means to make the value of the citizens’ wages and savings less, and the cost of servicing foreign debt higher.

Interestingly, having a stable currency and a high growth rate increases inflation. This makes sense because high growth increases demand for everything from office space to employees. Wages grow, rents grow and more money chasing fewer goods also causes prices to increase. This is good inflation as opposed to the inflation caused simply by an expansion of the monetary supply without growth in wages or the economy. In this case, the rise in prices can be used as an indicator that supply should increase to meet demand.

Lewis introduces an anecdote from Nicolaus Copernicus, the famous historical scientist. He noted that money is a measure of value, just the same as a meter is a measure of length and a kilogram a measure of weight. Without a stable and consistent measure of value “buyers and sellers [are] being cheated”.

Gold is not perfect as it can also be affected by supply, or more likely demand, but it has proven itself to be as stable, as we can hope for over millennia. Bitcoin, some say, was invented to create a stable, divisible, easy tradable and supply-restricted form of money. Whilst the latter aims have all been met, that of being stable has not! Its value has varied massively over the last decade driven largely by the demand. Its current market capitalization is said to be the same as that of physical silver, but the price of the latter is a lot more stable, and even more so for gold. Of course, you cannot look at the value of gold in dollars or any other fiat currency because you are more likely to see the fluctuations of that currency rather than in the value of gold. You cannot tell whether the value of gold went up, the value of the dollar went down, or some combination of the two.

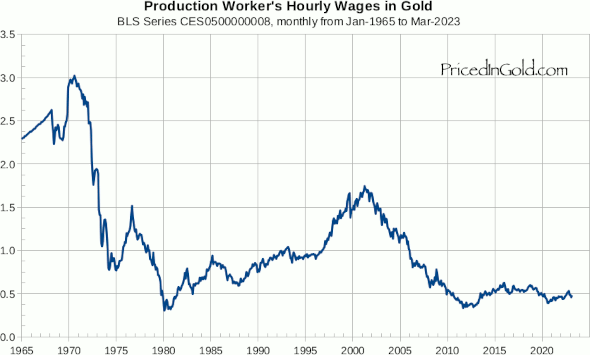

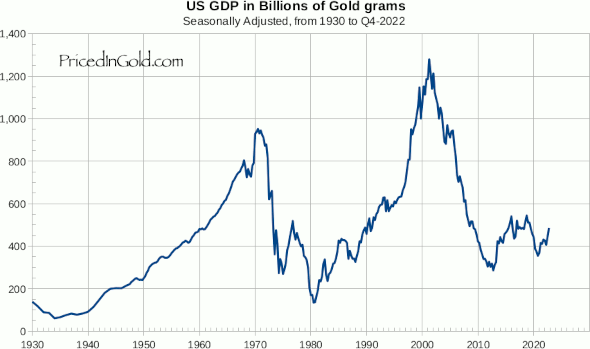

Much of the world has used Dollars or Euros as their anchor but in turn, the United States has found over the last 50 years since the gold-peg was eliminated, that the economy has performed best when the dollar is indeed pegged to gold, albeit loosely. The following charts show the US Production wages, US GDP and the S&P500 value against gold. All show 1970 as the peak in US wealth except for what could be considered extraordinary factors, the dot-com bubble which was created by large influxes of investment from abroad there was a seeming recovery in GDP and S&P performance but not matched by production wages, presumably, this is driven by the technology and finance sectors and therefore enriches the highest 1% of earners (the investor class).

Lewis points out that neither world wars nor the great depression made such an impact on the economy as an unstable currency.

Fixed Exchange

If a country desires to fix their currency, as it should, then it should consider a currency board as opposed to a currency peg. A currency board can be operated automatically:

- If the currency value is above the desired value then the monetary base is reduced by buying assets

- If the currency value is below the desired value then the monetary base is increased by selling assets

At least seventy countries, mostly developing, have suffered from hyperinflation just since 1970. This seriously derails the countries’ prospects for years to come. It brings risks of unstable government, lost investments and capital flight.

If the whole world had a single currency then there would be no need for fixing exchange rates. However, there would be no way to compare. The single currency could also become devalued and manipulated as the dollar has. The US has only prospered when the dollar was fixed or intentionally stabilized against gold. Those in charge of the single currency may find that they can intentionally use that currency to buy low and sell high (i.e. prior to their pre-planned manipulation), thus purchasing the world’s assets.

Private Property

Lewis assumes that a government seeking to prosper their nation will implement the magic formula of low taxes and a stable currency. He then makes the jump that such a government will also value private property and fair laws.

Whole systems of plunder have been tried from pirates to the Mongols to the Vikings to the Spanish, but all of these have failed to prosper as much as those living in a capitalist system.

I can now see the causes of some of the problems being experienced in Europe. Economic growth has slowed due to large social systems and higher taxes to pay for them. The currencies have been devalued leading to inflation without being matched by wage growth. Add to this a large influx of migrants and a stagnant housing sector and you have a recipe for high house prices. If the market were truly free then the housing supply would catch up to demand or wages would increase so that housing becomes affordable again. This takes years even up to a decade to play out. I think in the meantime the government could help ease the burden by stabilising the currency, reducing taxes and expanding the available housing stock, possibly by making land easier to build on, or by incentivising people to move to less popular areas. Maybe the rise of hybrid work will be enough to encourage people to move out of the overpopulated and overpriced areas such as inner cities and their nearby suburbs. My personal preference would be to allow the building of truly sustainable properties on farmland where these would be either earthen homes, wooden homes or caravans/tiny homes combined with a commitment to restore the land to its former condition should the home become vacant.

So perhaps inflation isn’t the culprit but currency devaluation together with the government policies of unchecked immigration. There are also zero-interest rate policies and multiple homeownerships to consider. Maybe a zero interest rate policy isn’t a bad thing, but the cause of the policy was the slowing economy. By setting interest rates to zero they were supposedly encouraging investment into the economy rather than having money languishing in savings accounts. The central banks participated in quantitative easing which devalued their currencies and was supposed to cause inflation. Government want inflation because it makes their debts easier to pay and can lead to a happier population if wages also increase. What if the governments had chosen to reduce taxes instead of print money, that would have also encouraged investments and stimulated the economy. It just goes against the socialist tendencies of today’s left-leaning governments.

High savings rates and interest rates create demand for the currency. Increased demand on a restricted supply generally leads to an increase in value. When the value of a currency increases then the cost of goods including foreign currencies decreases and this is deflationary. Deflation can be good for the population as it increases purchasing power but it tends to lead to decreased exports. Provided the overall business environment is attractive, this may not be a bad thing.

Growing Wealth

Lewis believes that from this simple foundation, the magic formula, and carried simply by the currents of growing wealth, the prospering nation will develop a robust legal and justice system, good education, banking and finance sectors and stable and honest government. A military will develop supported by a population who are supportive of the government, and international influence and relationships grow and develop.

He gives plenty of examples and I will just pull out one, Bulgaria. Bulgaria adopted communist principles from 1946 until 1990 and had the same economic results as the rest of the communist world. In 1991 they had a peaceful transition to democracy and with it capitalism. However, they kept high taxes and a floating currency, eventually experiencing hyperinflation in 1996 and 1997 before stabilising the currency using a currency board approach (automated) against the Euro. So not really a stable currency but at least a stable exchange rate and much more stable than before. Secondly, from 1998 onwards they started reducing the top personal income tax rate from 50% and a corporate tax rate from 40% until finally setting them both at 10% in 2009 and 2008 respectively. The effect on GDP (in USD) can be seen in the graph below. Pre-90’s communism, 90-2000 high taxes, post-2000 low taxes.

He goes on to say that a problem ensues as successive governments and generations take for granted the wealth of the country and forget the policies that brought them wealth. Taxes are raised to cover a budget deficit or to pursue vain enterprises or more socialist policies. A generation later the children envy the wealth of the previous generations, don’t understand that it was given to them by Capitalist policies and demand socialist policies in order to redistribute the wealth. At this point, the nation is in danger of a revolution.

Income Tax

Income tax is a fairly recent thing, meaning the last 100-200 years. The appeal of an income tax is that it can be fairly easy to collect. When Great Britain first introduced it the rate was set at 3% for the entire population, in over 70 years it never exceeded 6%. The US Constitution (Article I, Section 8) states that taxes should be applied uniformly to avoid the powerful oppressing the peasantry, or in a democracy, the majority oppressing the minority.

Lewis describes the income tax in more detail in a blog post. He describes it as a payroll tax and that there should be no deductions for healthcare, pensions, stock options etc. This makes complete sense. The individual trades time for money, the same way corporations trade goods for money, all profits on these transactions are taxed equally. There are no deductions for charitable giving, education, or anything. Employment from self-employment should be taxed the same as corporations. With a broad base and efficient collection system, the tax rate could be 15% and still be considered low.

I may want to come back to tax deductions for charitable giving because Charities on the whole perform many functions that are beneficial to society, however, in recent years we have seen that they become open to abuse, particularly by powerful and wealthy individuals. So perhaps taxing the incomes of charities would ensure wise and competitive stewardship of charitable resources.

The Great Recession

What happened in 2008 and how would it have turned out by following the magic formula principles? Expanding the monetary supply it turns out is not a bad thing if supply matches demand. Indeed, this is what needs to be done to maintain a stable value otherwise when demand outstrips supply then the value will rise. This happened during 2008 as demand for the US dollar increased. The increase was largely led by banks who demanded extra capital that resulted from the liquidity crisis and bad loans. Bank reserves were all below 10% as has been standard since the Fed started manipulating markets but in the 1950’s bank reserves of 40% were not uncommon and so banks would not have been nearly so affected by the collapse of one rogue bank.

Unpayable debt has gradually increased in the private sector in tandem with the decline of global currencies.

Fiscal stimulus, the use of increased government spending, is a legitimate way to stimulate an economy but only where it does not increase debt. An alternative to fiscal stimulus is monetary stimulus which is trying to get more money into the economy by playing with interest rates and increasing monetary supply. Ultimately both of these weaken the country as savings get lost, wages become depressed and debt and the burden of debt increases.

During recessions, people lose their jobs but may be able to find comfortable government positions at a time when the government should be reducing spending. The government will typically hold on to employees to maintain a perception of well-being whilst failing to pay for repairing potholes or providing basic services to the public. Governments are not held accountable to the expectations of efficiency as corporations are. But they must remain lean and efficient.

The supply of money should remain stable and follow the automatic rules of supply and demand. Interest rates should be determined by the free market and not by a manipulatory central bank or government. Governments only need to manage their own spending, balance their budgets and build efficient, affordable welfare programmes (if necessary) without interfering in trying to manage the economy.

Government Profligacy

The spending of the government tends to creep up unless they are targeting growth. Increasing taxes are generally opposed by the population, increasing taxes on the wealthy gets popular support, but can usually be avoided by the wealthy which results in very few actual gains. Through the twentieth century perhaps the world has learned that social welfare systems generally lead to bloat and inefficiencies. Experience has shown that a spending-to-GDP ratio of 10-15% may be ideal and the government kept as small as possible.

Hong Kong has a spending/GDP ratio of between 15 and 20% whilst providing public education, welfare and healthcare with an income tax rate of 16.5% and no VAT tax and few other taxes. Singapore has had similar success with similar policies.

History has shown that waning empires are associated with increasing philanthropic endeavours and declining religious adherence.

Conclusion

This has been an interesting read, although I’ll admit I skipped some of the historical examples and details.

The conclusion is a Stable Currency and Low Taxes are all that are required to make a nation prosperous.

The more efficient the tax collection mechanism the more tolerable higher rates will be and also the higher the tax revenues will be. This is typically done through payroll or income taxes.

Many that pursue this policy also have sales or VAT taxes. I believe VAT makes sense as it can be used to drive beneficial preferences in products and can be used to offset disposal costs or other societal costs attributable to the products (such as health effects). These can be hard to quantify and this book has caused me to consider the relative advantages of a flat-tax system with its low administrative burden. A parallel can be seen with the German Pfand system where plastic and glass bottles have a supplementary deposit applied at the time of purchase that can be returned when the bottle is returned to a store. The problem with the system is the additional cost of maintaining collection points and other administrative costs. Studies have shown that the system typically does not result in higher levels of recycling and neither does it provide any meaningful revenue that could go directly towards recycling centres.

Although a progressive tax system can work effectively it often results in little benefit over a broad-based flat tax system and may bring greater temptation to adjust the rates at each level. By having a single tax rate across all levels the government can appreciate immediately whether changes in the tax rate have the support of the people or not. The tendency of the majority will always be to persecute the minority.

Stable currency effectively means an automatic system where the currency is fixed to Gold. The value chosen does not matter although it would seem to make sense to do it at a level consistent with the current value of the currency in circulation.

Although the International Monetary Fund (IMF) has tried to ban the use of a Gold standard in recent years, it seems as though China and Russia are considering this very thing. Maybe they have felt the need to ban a gold standard because it would undermine their global currency goals where they become the masters of the currency.

A quote that both Nathan Lewis and Wayne Grudem use comes from Adam Smith in 1755:

Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice; all the rest being brought about by the natural course of things. All governments which thwart this natural course, which force things into another channel, or which endeavour to arrest the progress of society at a particular point, are unnatural, and to support themselves are obliged to be oppressive and tyrannical.

If you want to support this new work, volunteer some time, or simply keep track of what we’re doing then please subscribe.